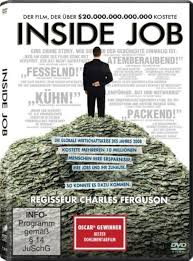

Matt Damon did wonderful work narrating Inside Job. This movie deserved a lot more awards than it got. They interviewed most everyone involved with Jamie Diamon’s mortgage fraud. What makes this documentary really special is they go all the way back to the Great Depression.

It is critical for everyone with a home mortgage or 401K to watch this documentary. I did two tours of duty working on trading floor systems for a stock exchange. I can tell you point blank that they have the mindset of Wall Street down cold.

Make money now, let the government sweep it up.

Watching it get worse

The march forward in time lets you watch it get worse. Each and every time banking regulations were relaxed it lead to a larger financial catastrophe. Bankers simply cannot be trusted with your money.

My favorite president, Ronald Reagan, relaxed banking regulations and it lead to the Keating Five. The federal government ponied up $124.6 billion of our tax dollars to clean up the mess. This created an economic slow down which contributed to the 1990-1991 recession. The slow down also contributed to Black Monday, October 19, 1987, where the DOW dropped 508 points.

DOT-BOMB

More deregulation and more financial scams. I was actually working at a stock exchange for Y2K when DOT-BOMB companies were all the rage. It was a bubble the size of the solar system. They kept needing more money via funding rounds yet were showing massive revenues. It was all a scam. A.com would “buy” millions of dollars of “services” from B.com. In turn B. com would “purchase” the same amount of “advertising” or whatever from A.com. These were wash transactions. No money actually changed hands yet they were booked as revenue by both companies.

Valley of the Boom does a great job explaining this for geeks that didn’t live through it. I lived through it. Wall Street and big banks fed it. Friday, March 10, 2000 is when the bubble hit peak size, then popped.

Keep in mind this is when Enron happened, along with Arthur Andersen’s late night shredding parties. That case happened in 2005.

Jamie Diamon’s Mortgage Fraud

I love how Inside Job explains the details of the mortgage fraud all of the major banks engaged in. What is better is the simple diagram they had. No, I didn’t thieve it.

Thanks to criminal deregulation of banks, you young whipersnappers don’t remember a time when people had to go to a bank to get a mortgage. Prior to all of the criminal deregulation of the banking industry, banks had to hold mortgages. All banks paid roughly 5.25% on passbook savings. All mortgages were roughly 6.25%. Admittedly there was a wee bit of fluctuation on the mortgage side but not a lot.

Banks were tasked with stabilizing and building the community. It was your passbook and CD savings they loaned out. Mortgages paid your interest. Once banks to lay the loans off, the bottom fell out of ethics.

Lost tax revenues and the cost of the bail out rose national debt from 66% GDB in 2008 to over 103% GDP by end of 2012.

Not one single banker from mahogany row went to prison.

AI

We are now in an AI bubble. It is even larger than DOT-BOMB and the mortgage fraud bubble. NVidia has begun investing in AI startups. These are many of the same companies buying their chips. We are back to DOT-BOMB wash sales inflating financial reports.

Large Language Model is not AI. When you can have your AI put its hand on the stove and learn the meaning of hot, then, and only then, do you have AI. I talk a lot about this in the sequel to this novel I’m writing.

Fake AI illegally hoovered up everything on the Internet and every electronic book it can find. I recently got notified I’m part of a settlement with one of them because they hoovered up Infinite Exposure. This is just the one that got caught.

By now you have all heard of Google’s AI generating pictures of black Nazi SS units fighting for Adolf Hitler during World War II. Most of you have heard about the lawyer preparing a brief for the Supreme Court where AI generated a fake precedent and insisted it was a real case.

In short, LLM generates shit. People are now using AI to generate books, blog posts, legal briefs, everything really. LLM is now eating its own shit. No entity can survive long doing that.

The AI crash may happen this year.

Affordability is a massive issue in the economy. The job market is much worse than the numbers are reporting and a lot of economists are starting to see that. Consumers are starting to pull back. Tech companies are massively over spending on data centers. Electricity prices are skyrocketing as power companies scramble to meet demand. Tariffs have screwed the pooch globally.

Mrs. O’Leary’s cow is about to kick and it will happen before the midterm elections are complete.

Summary

Whether you find it for free on Tubi (where I watched it) or some other streaming service, watch this movie. They did their homework.

For more movie rental ideas please see list one and list two.

One thought on “Review – Inside Job”