I was going to wait until Greg added another Financial Lesson installment then I started catching up on some 2017 podcasts I’d been meaning to listen to and listening to some recent TED stuff. When it comes to podcasts I pull down a year or so of the few I like and listen to them when helping out in the field. Our newer tractors have auto-steer systems so I only have to turn around on the ends and navigate waterways once I set the angle. Podcasts help keep the mind occupied.

It may not be pretty or cool, but that thing works everywhere. You cannot wear earbuds operating heavy equipment. You have to be able to actually hear what is going on around you.

Globally people are financially illiterate

The vast majority of people around the world cannot answer three simple multiple choice questions. Read or listen to this Frekonomics episode to find out the reality. This ties into my very first post on this subject.

Because You’re Worth It

LOreal commercial

Marketing types routinely exploit financial ignorance. If you cannot answer those three simple questions correctly, you can’t possibly come to the conclusion “you’re worth it.” When you were sheltering in place during the pandemic you should have brushed up on your financial literacy.

Financial Lesson: Nearly everyone is illiterate about finances. Take your pandemic down time to educate yourself via trusted sources.

We are standing at the cusp of the next Great Depression

Here is a TED talk you need to listen to. A Century of Money. Admittedly this would be easier to listen to if they didn’t have any of the background music. The early part of this talk covers much of the same ground as this term paper. You will also find much of that talked about in this 2013 book.

Yes, the talk explains the creation of the FDIC and SEC, but what you really need to pay attention to is the stock market bubble and the evictions.

Pumping up the stock market is easy. You give free money to the brokerage firms and they buy stocks. When you have drastically low interest rates you create a bubble. Trump created a stock market bubble. The central bank interest rate is really low. People who worked during the pandemic are having to make their year end/begin 401K contributions. Cash is flowing into the stock market at an unheard of rate right now and we have a massive bubble. The stock market is not connected to reality and I’m a loooong way from the first to be telling you this.

What created The Great Depression was too much cheap money chasing returns in a self inflating bubble.

The podcast points out the reason we had too much cheap money. Interest rates were held artificially low so Europe could rebuild from World War I (formerly known as The Great War.)

Today we have interest rates held artificially low because of the pandemic. The Fed has promised to keep them very low for a very long time. This creates a self feeding stock market bubble just like the one in front of The Great Depression. If you can borrow money at 3.25% and buy stocks that are gaining 6% or more per day people tend to do it. (At the time of this writing this link had the prime rate at 3.25%)

Now, are you really naive enough to believe only one Wall Street broker is taking the cheap money and doing this?

Financial Lesson – The Pump & Dump

Ordinarily you have to have fake news fed to gullible people (Trump Supporters) to make a pump & dump work. You buy while the price is low, release the fake news, watch the feeding frenzy and dump near the top before people find out there is no reason for the stock price to be going up.

Today we have all of this cheap money flowing into banks and brokerage firms.

A group of bankers and brokers “follow an analyst” from another firm or so they claim. Analyst publishes a change of rating from SELL or HOLD to BUY. Banks and Brokers get tons of cheap money from Fed and buy tons of shares microseconds after the news comes out. Mere mortals then hear news reports about the amazing gains of XYZ stock. We take our “stupid money” and buy XYZ stock chasing returns. After the price goes up 12-30% the big players cash out, pay off the short term note and pocket the profits.

Tomorrow there is a new stock and a new loan and a new Pump & Dump.

When you see the trusted news outlets talking about a disconnect between the stock market and reality you don’t have to know much other than “don’t be chasing stocks now.”

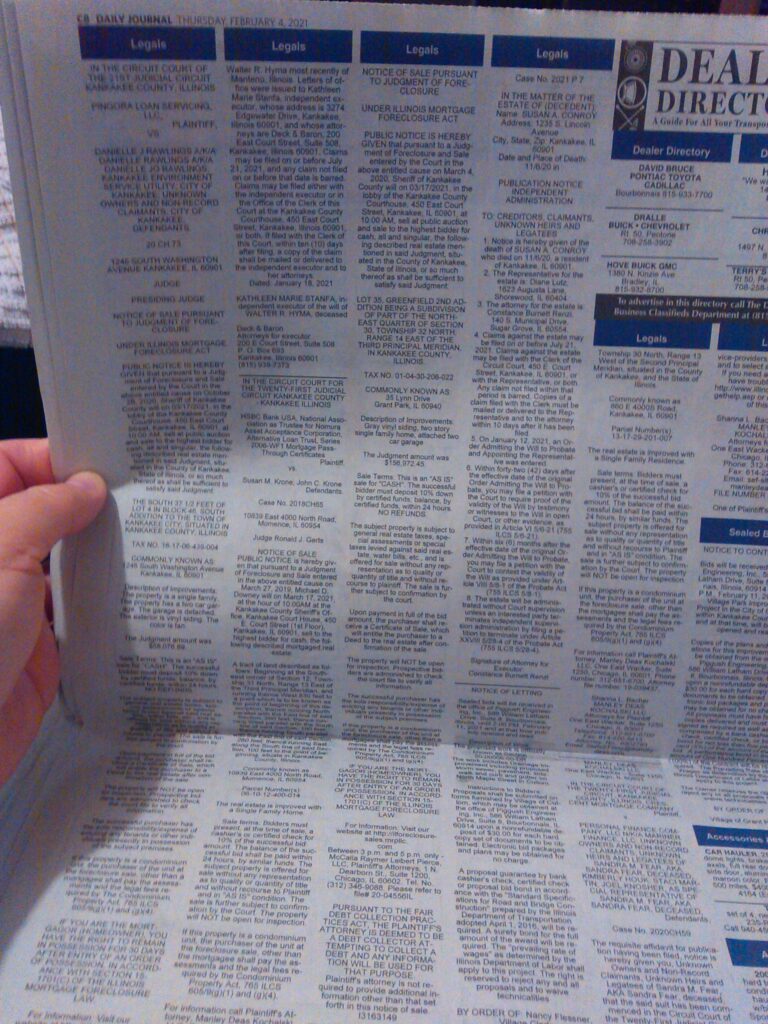

The Foreclosure Death Spiral

In my first installment I told you that the foreclosure moratorium would not last forever. In fact some some asshole states like Texas have been declaring the protection unconstitutional and going forward with evictions and foreclosures.

March 1, 2021 update: On February 25, 2021, a federal district court from the Easter District of Texas ruled in Terkel v CDC that the CDC order is unconstitutional. According to a press release from the Department of Justice, this order only effects the landlords in that case (Lauren Terkel, Lufkin Creekside Apartments, Lakeridge Apartments, and MacDonald Property Management). The CDC order continues to apply to other landlords in Texas and other parts of the country.

One of the things the TED podcast did a good job with was spelling out The Great Depression wasn’t just caused by the stock market crash or the run on the banks. It was the wide spread evictions and foreclosures. FDR stopped the run on the banks by recognizing the banking paradox.

If you can get your money any time you want, you don’t want it. When you think you might not get your money there is a panic and you race to the bank.

They solved the banking paradox by declaring the banking holiday where they drove cash to all of the banks and creating the FDIC. Previously banks weren’t insured. Today accounts are insured up to $250,000 at most FDIC banks.

Financial Lesson: You don’t worry about your bank going under because you know your money is insured by the Federal government.

The Foreclosure Death Spiral has not been solved. You would think the Federal government would have put something in place after the mortgage crisis, but they obviously not.

This moratorium will end. The rental assistance only goes so far. Other than the unemployment checks, I don’t know what they have for mortgage assistance.

This shoe will drop. You need to think about what life and society will be like when 1/4 to 1/3 of the general population is suddenly homeless. Crime goes up because people have to eat and find shelter. Good people are forced to do bad things just to survive.

Mitch McConnell and the GOP in Washington sure as Hell aren’t going to help anyone but the wealthy. They’ve made it clear that they don’t care about Americans with their vote on the relief package and their bitching about the infrastructure package.

Yes Mitch, Broadband Internet is infrastructure. We don’t travel by horse and buggy anymore. Remote learning cannot happen without it. Yes Mitch, remote learning will still be a thing even after the pandemic. Schools will no longer have “snow days” because class can be online. Most schools will keep in place some form of hybrid schedule because it’s the cheapest way to reduce class size. Yes, the teachers may have just as many students but you don’t have to cram 80 students into a room meant for 40 and you don’t have to hold class in construction trailers because your district cannot afford to build another school.

Admittedly not all students and not all grades will have hybrid learning post-pandemic. Many schools will have some form of it just to reduce the crowding. They can’t do that unless broadband Internet is everywhere.